Summary

-

AI agents enable autonomous, real-time decision-making that goes far beyond rule-based automation used in traditional banking systems.

-

By combining machine learning, real-time analytics, and advanced document processing, AI agents handle complex financial workflows with greater speed and accuracy.

-

Financial institutions use AI agents to strengthen fraud detection, accelerate loan processing, and improve compliance while reducing operational risk.

-

AI agents support scalable, always-on customer engagement through AI-powered customer support and personalized financial insights.

-

Agentic AI helps banks modernize legacy systems, automate accounts payable and receivable, and improve end-to-end operational efficiency.

-

As adoption grows, AI agents are becoming core to competitive advantage, enabling banks to innovate faster while meeting regulatory and governance requirements.

We’re living in a decade where technological breakthroughs are rewriting the rules of entire industries, and banking and finance are no exceptions. Traditional models built on manual processes and siloed systems are rapidly giving way to intelligent, autonomous, and highly responsive digital ecosystems powered by software development and IT services. At the center of this shift are artificial intelligence agents—autonomous systems capable of analyzing data, making decisions, and learning in real time.

From fraud detection, loan processing, accounts payable and accounts receivable automation, to AI-powered customer support, AI agents are transforming how financial institutions operate, compete, and serve customers.

In the post-pandemic era, banks and financial services firms are accelerating digital innovation through AI services, agentic AI, and low-code or no-code development platforms. Leaders increasingly recognize that AI Agents in Finance are not just another technology trend but a natural progression of digital transformation. Industry research supports this momentum, projecting AI investment in financial services to grow from over $35 billion in 2023 to nearly $97 billion by 2027, with significant focus on agent-driven automation.

Today, AI agents are no longer simple assistants or basic AI chatbots—they are strategic partners delivering AI-driven insights, reducing risk, and enabling personalized financial experiences. ZYNO by Elite Mindz supports this transition with secure, scalable, and compliance-ready ZYNO AI- AI agent platforms built for enterprise banking.

AI Agents and Its Significance in Banking and Finance

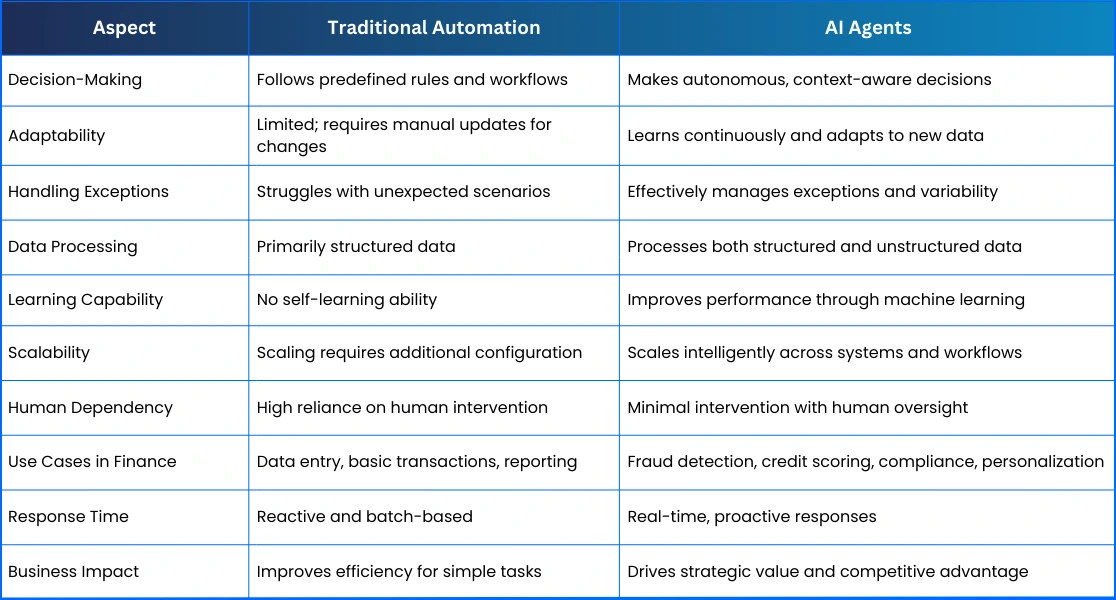

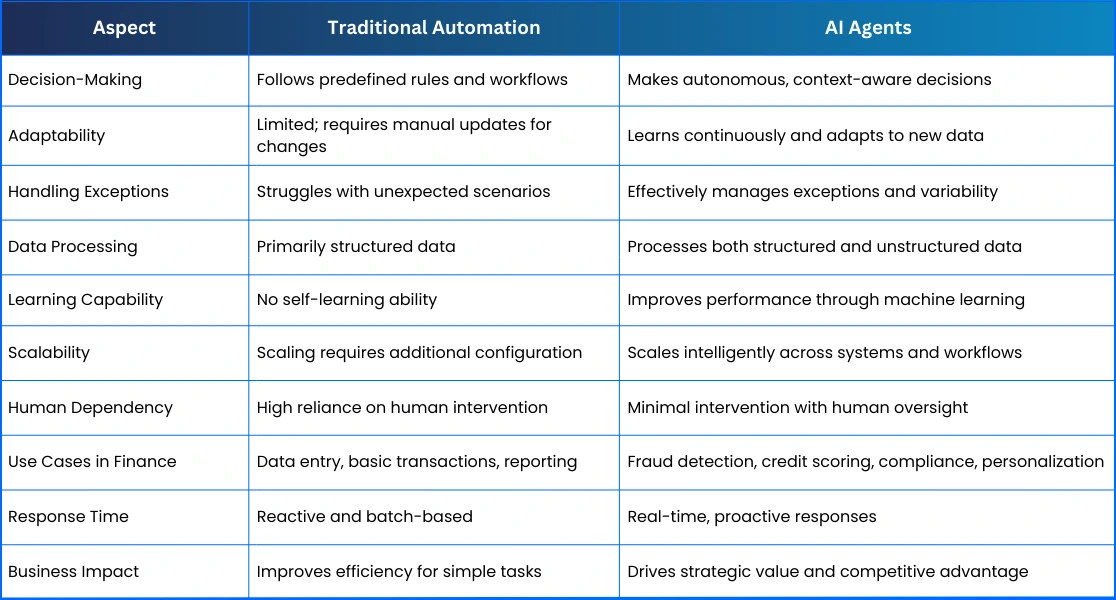

In simple terms, AI agents in finance are autonomous systems designed to operate independently within complex digital environments. They gather structured and unstructured data, apply machine learning, execute actions across systems, and continuously improve through learning. Unlike traditional automation, AI agents adapt to change, making them ideal for modern banking and finance software development initiatives. They handle variability across lending, compliance, customer engagement, and financial operations.

Traditional automation tools work well for repetitive, predictable tasks. However, they struggle when exceptions arise or when decisions require interpretation. AI agents overcome this limitation by combining reasoning, learning, and execution into a single intelligent framework. As a result, they can handle complex, variable processes that demand speed, accuracy, and continuous improvement.

Core Technologies That Power AI Agents

Machine Learning (ML):

Machine learning enables AI agents to learn from historical data and deliver predictive, AI-driven insights. In finance, ML strengthens credit scoring, fraud detection, risk modeling, and forecasting.

Natural Language Processing (NLP):

NLP powers conversational AI chatbots and AI-powered customer support, enabling intelligent interactions across chat, voice, and email while processing unstructured financial documents.

Real-Time Data Analytics:

Real-time analytics and monitoring allow AI agents to respond instantly to transactions, detect anomalies, and support regulatory compliance across banking systems.

Computer Vision & Document Intelligence:

Through advanced document processing, AI agents extract data from KYC files, invoices, statements, and contracts—automating onboarding and compliance workflows.

Decision Intelligence & Rules Engines:

Decision intelligence combines predictive models with rules engines, enabling agentic AI systems to make explainable, compliant financial decisions.

AI Agents vs Traditional Automation

The Current Landscape: Adoption Trends and Industry Growth

AI adoption across banking and finance is accelerating, driven by demand for AI services, agent-based automation, and intelligent financial platforms:

-

Roughly 60% of financial institutions are using AI across multiple functions such as fraud detection, lending, compliance, and customer service.

-

AI adoption in finance has surged from 45% in 2022 to an estimated 85% by 2025

-

A growing number of banks and insurers are deploying AI agents for customer onboarding, fraud detection, loan processing, and more.

Market projections also show explosive growth in AI agent technology within financial services. According to industry analysis, the agentic AI market could expand from around USD 5.5 billion in 2025 to over USD 33 billion by 2030, driven by demand for autonomous decision-making and operational efficiencies. These numbers clearly signal that AI agents are becoming core strategic differentiators for leading financial players.

Key Applications of AI Agents in Banking and Finance

Major key applications are as follows:-

1. Intelligent Customer Service & Virtual Assistants

AI agents power conversational AI chatbots and AI-powered customer support systems, provide account support, and guide users through services 24/7, improving response times and customer satisfaction.

2. Fraud Detection & Financial Security

AI agents use real-time analytics and monitoring, identify unusual patterns, and flag potential fraud instantly. Their ability to learn from new threats strengthens security and reduces financial losses.

3. Automated Loan Processing & Credit Assessment

By combining machine learning and advanced document processing, AI agents accelerate approvals and reduce risk.

4. Risk Management & Regulatory Compliance

AI agents support accounts payable, accounts receivable, and compliance workflows through intelligent monitoring, helping financial institutions maintain audit readiness and meet evolving regulatory requirements.

5. Personalized Financial Insights & Wealth Management

AI agents deliver hyper-personalized, AI-driven insights that enhance customer engagement and retention.

Business Benefits of AI Agents

AI agents deliver measurable value across banking and finance IT services, including operational efficiency, cost reduction, faster decision-making, and scalable innovation.

Operational Efficiency

AI agents automate repetitive, time-consuming processes across departments, reducing manual workload, minimizing errors, and enabling employees to focus on strategic, high-impact business activities.

Cost Savings

By automating customer service, onboarding, compliance, and back-office operations, AI agents significantly reduce operational expenses while improving productivity and resource utilization across the organization.

Faster Decisions

AI agents analyze real-time data instantly to support faster, more accurate decisions for loan approvals, risk assessments, fraud detection, and regulatory compliance checks.

Better Customer Experiences

With 24/7 availability, personalized interactions, and faster issue resolution, AI agents deliver seamless, consistent customer experiences that improve satisfaction, trust, and long-term loyalty.

Competitive Advantage

Organizations adopting AI agents gain agility, scalability, and innovation leadership, enabling them to deliver smarter financial services, adapt faster to market changes, and manage risks effectively.

Essential Features of an AI Agent Platform

Features of an AI agent platform includes:-

1. Autonomous Decision-Making Capabilities

A robust AI agent platform enables agents to independently analyze data, evaluate scenarios, and make informed decisions without constant human intervention, ensuring faster and more efficient operations.

2. Advanced Machine Learning

The platform should support machine learning models that continuously learn from new data, improving accuracy, adaptability, and performance across changing business and regulatory environments.

3. Natural Language Understanding & Interaction

Strong natural language processing allows AI agents to understand, interpret, and respond to human language through chat, voice, and text, enabling seamless customer and employee interactions.

4. Real-Time Analytics & Monitoring

An effective AI agent platform processes large volumes of data in real time, allowing agents to detect patterns, respond to events instantly, and support time-sensitive financial decisions.

5. Secure Integration with Enterprise Systems

The platform must integrate smoothly with core banking, ERP, CRM, and third-party systems while maintaining strong data security, privacy controls, and regulatory compliance.

6. Governance, Explainability & Compliance Controls

Built-in governance features ensure transparency, auditability, and explainable AI decisions, helping organizations meet regulatory requirements and maintain trust in AI-driven outcomes.

Challenges and Considerations When Implementing AI Agents

Challenges and considerations to keep in mind are:-

1. Data Quality and Availability

AI agents rely heavily on accurate, well-structured data. Poor data quality, silos, or inconsistencies can limit effectiveness and lead to unreliable outcomes.

2. Regulatory Compliance and Governance

Banking and finance operate under strict regulations. Ensuring AI agents comply with evolving regulatory standards and maintain transparent decision-making is a critical challenge.

3. Data Privacy and Security Risks

Handling sensitive financial and customer data requires strong security frameworks. AI agent platforms must protect against breaches, misuse, and unauthorized access.

4. Integration with Legacy Systems

Many financial institutions run on legacy infrastructure. Integrating AI agents with existing systems can be complex and requires careful planning and execution.

5. Skills Gap and Change Management

Organizations often lack skilled professionals to manage and supervise AI agents. Training teams and managing organizational change are essential for successful adoption.

6. Trust, Explainability, and Ethical AI

Building trust in AI decisions is vital. AI agents must be explainable, unbiased, and ethically governed to ensure confidence among stakeholders and regulators.

What’s Next: The Future of AI Agents in Finance

1. Multi-Agent Collaboration Across Financial Systems

Future financial ecosystems will rely on multiple AI agents working together across departments, sharing insights and coordinating actions to deliver faster, smarter, and more consistent outcomes.

2. Fully Autonomous Financial Decision-Making

AI agents will increasingly handle end-to-end financial decisions—from credit approvals to fraud prevention—while humans focus on oversight, strategy, and exception handling.

3. Deeper Integration with Core Banking and ERP Platforms

Agentic AI will become tightly embedded within core banking, ERP, and financial management systems, enabling seamless automation across finance, compliance, and operations.

4. Hyper-Personalized Banking and Financial Services

AI agents will deliver highly personalized financial experiences by continuously analyzing customer behavior, preferences, and goals in real time across digital channels.

5. Stronger AI Governance and Responsible AI Frameworks

As adoption grows, financial institutions will invest heavily in explainable, ethical, and compliant AI frameworks to ensure transparency, fairness, and regulatory alignment.

6. Agent-Driven Financial Innovation and New Business Models

Agentic AI will unlock new revenue streams, enable intelligent financial products, and support innovative business models that adapt quickly to market changes and customer needs.

How ZYNO AI Empowers Your AI Journey

Adopting AI agents is not just a technology upgrade—it’s a strategic transformation. Elite Mindz, through its ZYNO AI platform, empowers financial organizations to move from AI experimentation to real, measurable business impact by combining deep industry expertise with scalable, enterprise-ready AI solutions.

Strategic AI Consulting & Roadmapping

ZYNO AI works closely with stakeholders to identify high-impact use cases, assess AI readiness, and create a clear roadmap aligned with business goals, compliance needs, and long-term growth strategies.

Secure & Compliant AI Agent Implementation

ZYNO AI enables the deployment of AI agents that integrate seamlessly with existing banking and financial systems. Built with security, privacy, and regulatory compliance at the core, ZYNO ensures responsible and reliable AI adoption.

Seamless Integration with Enterprise Systems

From core banking platforms to ERP, CRM, and compliance tools, ZYNO AI connects AI agents across the enterprise—breaking silos and enabling end-to-end intelligent automation.

Scalable, Future-Ready Architecture

ZYNO AI’s modular architecture allows organizations to start small and scale AI capabilities across departments, geographies, and workflows without disruption.

Conclusion

AI agents are redefining banking and finance by enabling autonomous decision-making, intelligent automation, and data-driven innovation. For institutions investing in software development and IT services, adopting AI Agents in Finance is now a strategic imperative.

Ready to lead your industry with AI? Get in touch with ZYNO AI today and elevate your AI journey.

Checklist: Is Your Organization Prepared?

-

Clear business goals for AI agent use cases

-

Data governance and privacy protocols in place

-

Compliance and regulatory frameworks aligned with AI solutions

-

Cross-functional AI education and training for staff

-

Pilot & scale roadmap for AI deployment

-

Mechanisms for ethical and explainable AI monitoring

Frequently Asked Questions

What exactly are AI agents in finance?

AI agents are autonomous systems capable of perceiving data, reasoning, making decisions, and executing tasks with minimal human input.

How do AI agents differ from traditional AI tools?

Unlike traditional models that follow predefined rules, AI agents can act autonomously, learn from new data, adapt to situations, and interact with systems in real time.

What are the biggest benefits of using AI agents in banking?

Key benefits include operational efficiency, cost savings, enhanced customer service, faster decisions, and better risk and compliance management.

Are there risks associated with AI agent adoption?

Yes — challenges include regulatory compliance, data security, and building a workforce capable of supervising AI systems effectively.

How can ZYNO by Elite Mindz help my financial business adopt AI agents?

ZYNO by Elite Mindz provides strategic guidance, integration expertise, and implementation support to ensure your AI agent initiatives deliver measurable results and competitive advantage.

×

×

ZYNO Manufacturing ERP

+

ZYNO Manufacturing ERP

+

Production Planning & Scheduling

Production Planning & Scheduling

Quotes & Sales Orders (Manufacturing CRM)

Quotes & Sales Orders (Manufacturing CRM)

Product Configurator

Product Configurator

Mobile App

Mobile App

AI-Powered Demand Forecasting

AI-Powered Demand Forecasting

Field Service Management

Field Service Management

Ticket Management Software

Ticket Management Software

Training Management System

Training Management System

Document Management

Document Management

Human Resources & Time Tracking

Human Resources & Time Tracking

Analytics & Reporting

Analytics & Reporting

Expense Management Software

Expense Management Software

.webp) Bill of Materials (BOM)

Bill of Materials (BOM)

Finance & Cost Accounting

Finance & Cost Accounting

Statutory Compliance & Taxation

Statutory Compliance & Taxation

Subcontracting & Outside Processing

Subcontracting & Outside Processing

Project-Based Manufacturing

Project-Based Manufacturing

Quality Control & Compliance

Quality Control & Compliance

Maintenance & Asset Management

Maintenance & Asset Management

Procurement & Supplier Management

Procurement & Supplier Management

Inventory & Warehouse Management

Inventory & Warehouse Management

Vendor Management Software

Vendor Management Software

Live Shop-Floor

Live Shop-Floor

ZYNO Procurement

+

ZYNO Procurement

+

ZYNO CRM

+

ZYNO CRM

+

ZYNO HRMS

+

ZYNO HRMS

+

Integrated recruitment

Integrated recruitment

Learning management

Learning management

Mobile app

Mobile app

HR chatbot

HR chatbot

Custom services

Custom services

HR automation

HR automation

Business chat and collaboration

Business chat and collaboration

Employee engagement

Employee engagement

Integrated travel and expense

Integrated travel and expense

Integrated payroll software

Integrated payroll software

Compensation management

Compensation management

Onboarding

Onboarding

Performance management

Performance management

HR analytics

HR analytics

Digital Document management

Digital Document management

HR help desk

HR help desk

Timesheets

Timesheets

Leave management

Leave management

Shift management

Shift management

Attendance management

Attendance management

Employee management

Employee management

Integrations

Integrations

ZYNO Assets

+

ZYNO Assets

+

.webp) ZYNO EduVibe

+

ZYNO EduVibe

+

ZYNO Upskill

+

ZYNO Upskill

+

ZYNO Rewards

+

ZYNO Rewards

+

ZYNO HIMS

+

ZYNO HIMS

+

ZYNO Expenz

+

ZYNO Expenz

+

ZYNO Legal

+

ZYNO Legal

+

ZYNO Audit

+

ZYNO Audit

+

ZYNO Retail

+

ZYNO Retail

+

ZYNO Recruit

+

ZYNO Recruit

+

ZYNO Projects

+

ZYNO Projects

+

ZYNO Books

+

ZYNO Books

+

ZYNO POS

+

ZYNO POS

+

Search Engine Optimization

+

Search Engine Optimization

+

Generative Engine Optimization (GEO)

Generative Engine Optimization (GEO)

Paid Media & Advertising

+

Paid Media & Advertising

+

Amazon Marketing Services

+

Amazon Marketing Services

+

Social Media Marketing

+

Social Media Marketing

+

Content Marketing

+

Content Marketing

+

Conversion Rate Optimization

+

Conversion Rate Optimization

+

Online Reputation Management (ORM)

+

Online Reputation Management (ORM)

+

Analytics, Strategy & Consulting

+

Analytics, Strategy & Consulting

+

Brand Management

Brand Management

E Commerce Marketing

E Commerce Marketing

.webp)

-1.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)